Successful stock investing involves buying low and selling high, so stock valuation is an important consideration for stock selection.

#Xcel energy stock price free

Sign Up to Receive a Free Special Report That Shows How A+ Investor Grades Can Help You Make Investment Decisions

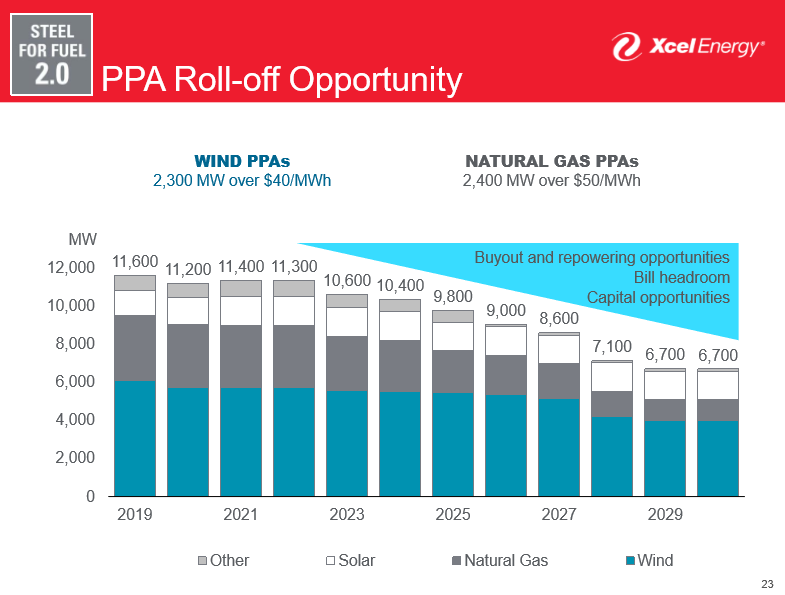

This should expand utility rate bases, provide opportunity for new rate increases, and allow utilities to tap into tax incentives for clean energy investments. On the other hand, electric grid and gas main repairs and upgrades, investment in electric transmission infrastructure, and new clean power generation are projected to lead to record levels of capital expenditures. Data from Regulatory Research Associates (RRA) through December 27, 2022, shows that the average electric utility authorized ROE was 9.54%, somewhat above the 2021 full-year average of 9.38%.

#Xcel energy stock price driver

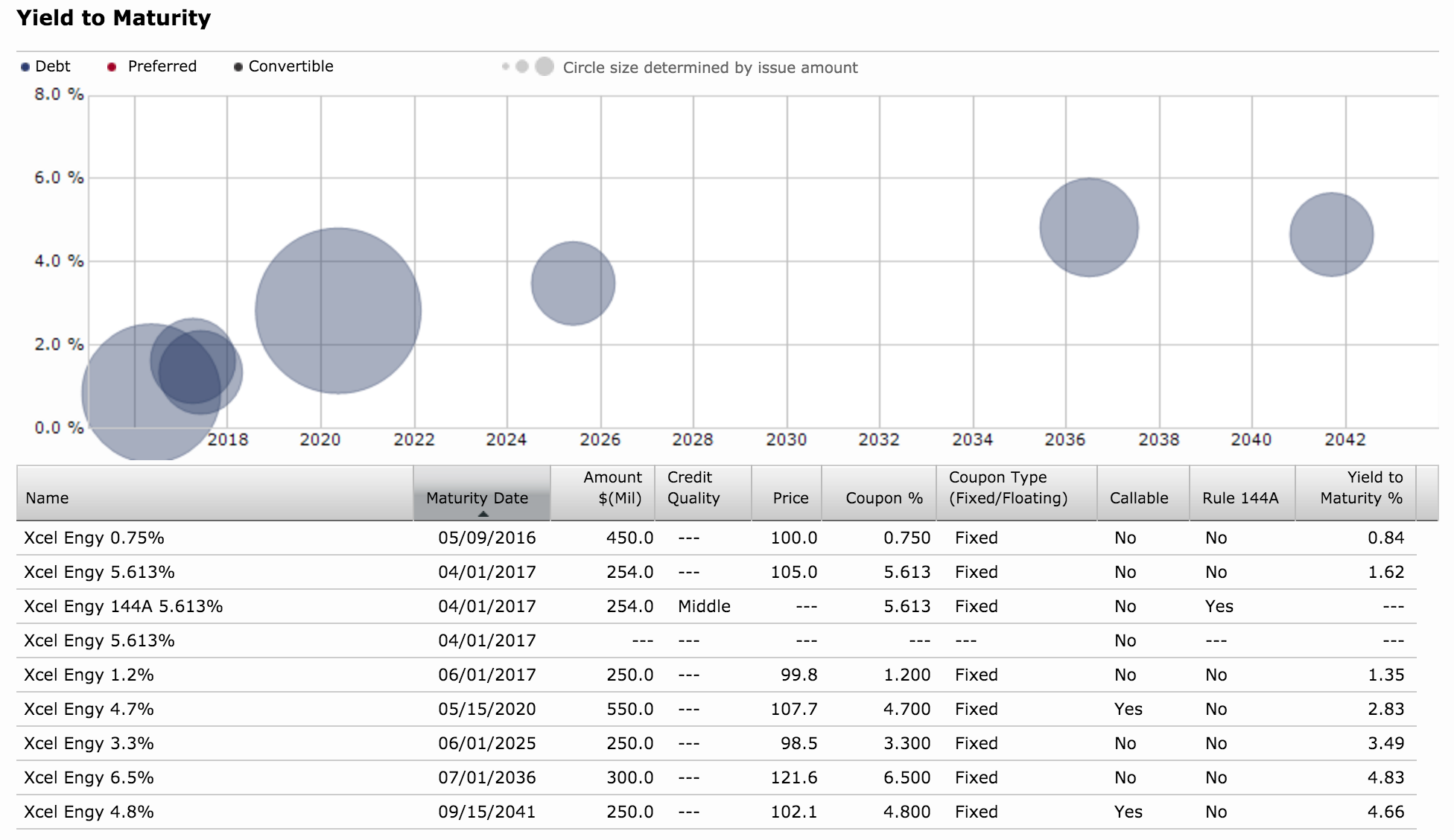

Recent trends also indicate a stricter regulatory environment expected to continue in the near-term, which will see downward trends in authorized return on equity (ROE), a key driver of utility earnings. For these reasons, utilities are seeking regulatory assistance, for utilities without interim rate relief mechanisms, this situation can increase “regulatory lag” - the delay in time between when utilities make needed expenditures and when their regulators authorize new rates to recover the costs. Furthermore, due to higher labor costs, higher supply, and increasing interest rates, operations and maintenance expenses and borrowing cost are expected to remain high or increase for debt-heavy industries such as the electric utilities industry. Energy Information Administration (EIA), annual residential electricity sales are forecasted to decline around 2% in 2023, while commercial and industrial sales growth is expected to be flat, as well as 2.2% growth in residential electric sales, near flat commercial sales growth, and around 1.2% growth in industrial sales for 2024. will enter a recession in the near future, economic conditions such as housing starts and unemployment could begin to deteriorate, leading to slow growth in retail electric demand. Specifically, because many expect that U.S. The industry is predicted to experience negative effects from several near-term operating headwinds, but these are to be balanced out by record-level projections for capital spending that is expected to support earnings growth. The fundamental outlook of the industry over the next twelve months is neutral. Xcel Energy Inc currently has a 3.2% dividend yield. Analysts expect adjusted earnings to reach $3.368 per share for the current fiscal year. Year-over-year quarterly sales growth most recently was 8.8%. Xcel Energy Inc’s trailing 12-month revenue is $15.6 billion with a 11.3% profit margin. Read on to find out how ( XEL) grades on certain investment factors and determine whether it meets your investment needs.Īs of July 13, 2023, Xcel Energy Inc had a $35.1 billion market capitalization, putting it in the 95th percentile of companies in the Utilities - Electric industry.Ĭurrently, Xcel Energy Inc’s price-earnings ratio is 19.9. Learn more about whether Xcel Energy Inc is a good stock to buy or sell based on recent news as well as its key financial metrics.

0 kommentar(er)

0 kommentar(er)